Every third day until Christmas, we will reveal three evaluation markers to improve your company’s odds for success in offshore wind. As a special Christmas reflection, each release will also contain a strategic observation from the global offshore wind scene.

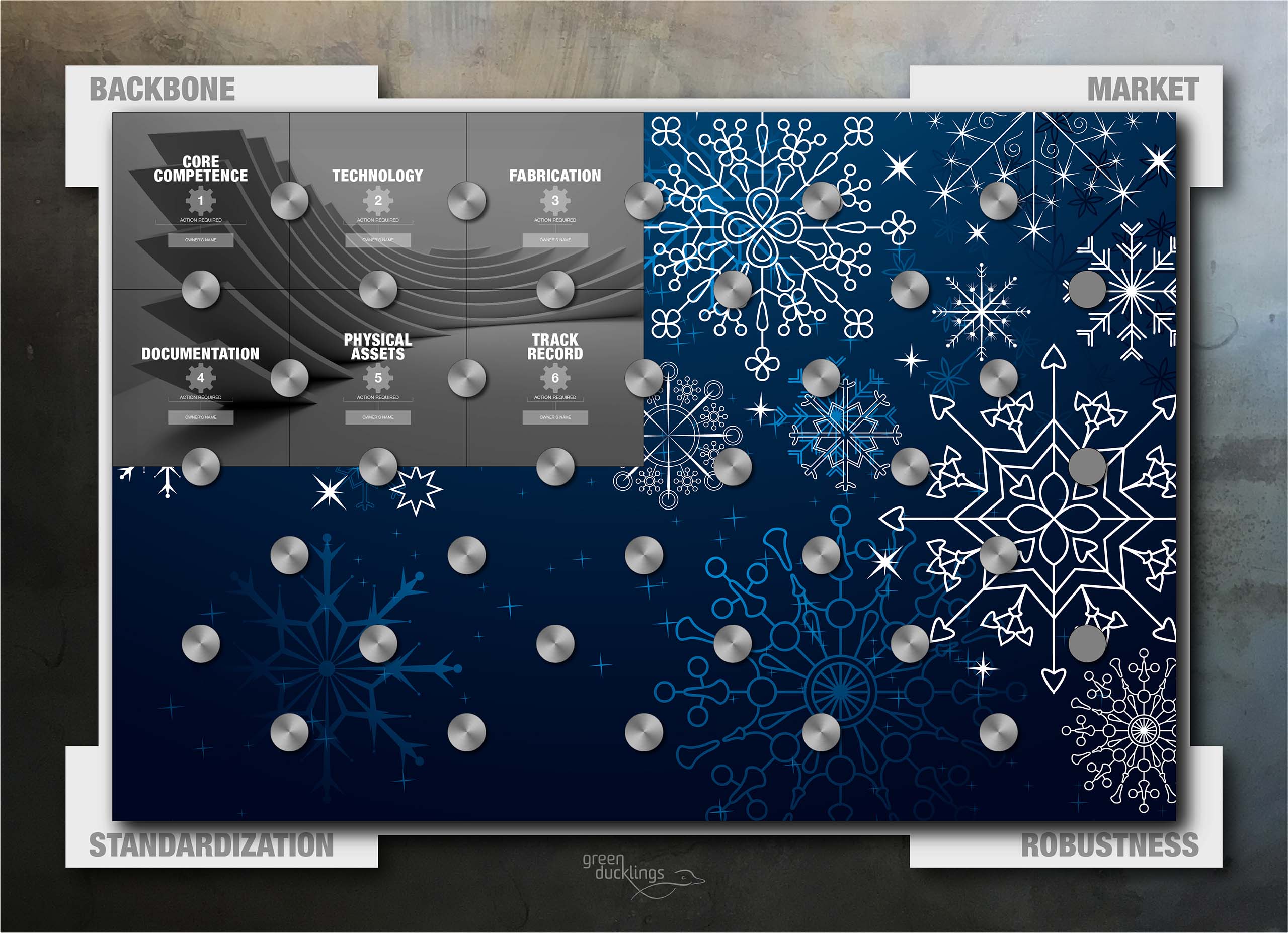

The Christmas Calendar structure reflects the Green Ducklings framework that we use to map any company’s “Offshore Wind DNA” through our 24 DNA Markers.

#4 DOCUMENTATION

Documentation is a measure for a company’s ability to handle the documentation requirements for the offshore wind business. General skills like Vendor Data Manuals, Fabrication- and Engineering Reports are a good start. However, your company should also possess knowledge about the special industry standards and recommended practices from stakeholders like DNV GL and national regulatory bodies. Some require translation into local languages. For special design tasks related to the dynamics of offshore wind structures, it is recommended to seek experienced guidance.

#5 PHYSICAL ASSETS

Physical Assets is a measure for the offshore wind suitability of a company’s strategic assets like vessels or fabrication yards. It can be used as a differentiating factor when competing in the industry. The suitability of vessels is highly dependent upon crane capacity and lifting heights, but other elements like the type of vessel, speed and deck capacity can also play a role. For yards, the geographical location is of high importance, since local job creation is often required for new markets. Equally important are the properties of the facility within elements such as crane capacity, fabrication halls, storage area and connecting infrastructure.

#6 TRACK RECORD

Track Record is a measure for the comfort that offshore wind clients will feel when contracting a Company to be part of their projects. This links to the risk premiums that the client will apply to their cost models, and it means that a “newcomer” to the industry will need to be more aggressive on price, as compared to an experienced offshore wind company. Therefore, it is of importance to list and take benefit from specific track record elements from other industries, that can be directly applied into Offshore Wind.

CHRISTMAS REFLECTIONS FROM THE MARKET

New markets are added to the Offshore Wind industry every month, and the global scaling of our industry has just begun. The current projections of capacity to be installed in the coming decades will require a massive scaling of the supply chain. The recent 1400GW ambition by 2050 will mean CAPEX-investments in the range of 3,0 Trillion USD. This means exponential economic growth for the supply chain and the developers. But it also means an estimated 1,88 Trillion USD of social wealth creation by saving public health costs. And it means realization of up to 10% of the CO2 reductions required to meet the Paris compliant 1,5o pathway in 2050. A world of opportunities for Green Swan supply chain companies has been opened for the coming years.