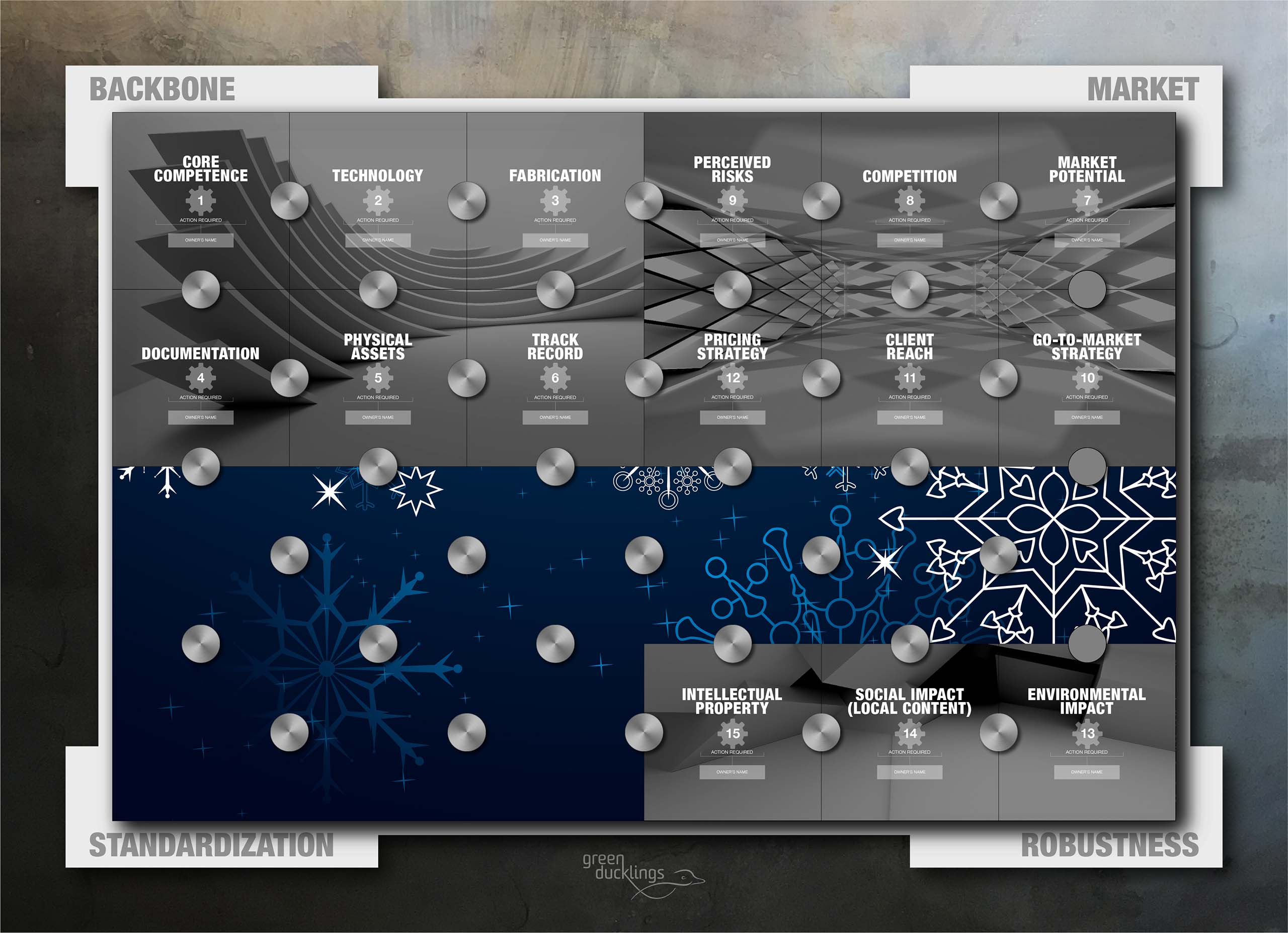

Every third day until Christmas, we will reveal three evaluation markers to improve your company’s odds for success in offshore wind. As a special Christmas reflection, each release will also contain a strategic observation from the global offshore wind scene.

The Christmas Calendar structure reflects the Green Ducklings framework that we use to map any company’s “Offshore Wind DNA” through our 24 DNA Markers.

#13 ENVIRONMENTAL IMPACT

Environmental Impact is a measure for a company’s ability to turn awareness of environmental benefits into a competitive advantage. Since the first zero-subsidy-bids in 2016, governments have been lacking decision parameters for awarding power purchase agreements (PPA’s). Until then, PPA’s were awarded to the compliant bidder with the lowest cost per MWh. There are signs that CO2-impact of the offshore wind industry itself is increasingly more important to developers. Their supply chains are often left with the task of quantifying environmental benefits. A reduced environmental impact can help to balance the risk of stakeholders delaying the permitting, construction or operational phases of the project.

#14 SOCIAL IMPACT

Social Impact is a measure for a company’s ability to use local job creation as an embedded aspect of their offering. When bidding for offshore leases or PPA’s, the developers often need to maximize local job creation promises to be successful. These promises affect the selection of suppliers. In most offshore wind sectors, the local content comes with a cost/risk premium, as compared to a cost-optimal supply chain. Therefore, the successful supplier is most often the one that finds the best balance between maximum local job creation and minimum risk/cost impact to the supplied products or services.

#15 INTELLECTUAL PROPERTY

Intellectual Property is a measure for the extent that offshore wind companies use patents, knowhow and business secrets as strategic elements. Products that have embedded advantages within economic, social or environmental benefits can be very valuable if backed up by formalized patents and business secrets – especially for M&A target companies. Like every other competitive element, the cost and the benefit needs to be balanced when investing in protection of Intellectual Property.

CHRISTMAS REFLECTIONS FROM THE MARKET

Many stakeholders have critical influence on the Offshore Wind Industry through the development and construction phases of the project. To balance the risk of not getting or delaying a permit or a PPA, the developers need to give promises to the (often local) stakeholders. The promises are often very specific regarding preferred technology and related supply chain and is prepared through a ”base case” supply chain. The promises from the development phase become constraints to the supply chain in the construction phase. This means that successful Tier 1 and Tier 2 suppliers understand how to engage with developers on both technical and commercial levels long before any Request for Quotations are issued to the market. Only in this way, they can increase the ability to comply with the developer´s requirements.