Every third day until Christmas, we will reveal three evaluation markers to improve your company’s odds for success in offshore wind. As a special Christmas reflection, each release will also contain a strategic observation from the global offshore wind scene.

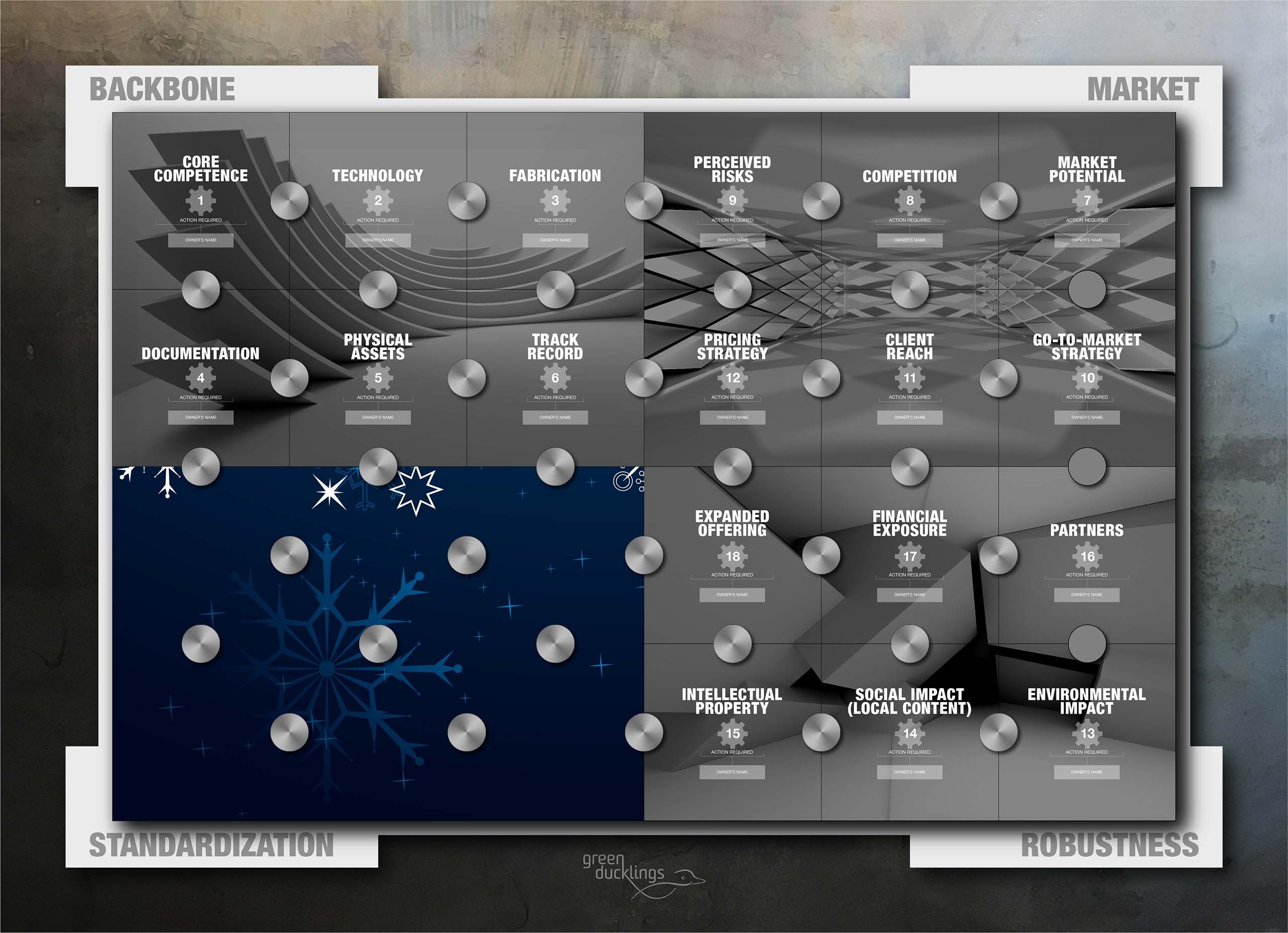

The Christmas Calendar structure reflects the Green Ducklings framework that we use to map any company’s “Offshore Wind DNA” through our 24 DNA Markers.

#16 PARTNERS

The use of Partners is a measure for a company’s ability to offload or balance risks and differentiate from competitors through strategic partnerships. Due to the scale and risk profile of offshore wind projects, large contractors either have difficulties possessing or have strategically decided not to have all expertise internal. Some choose to partner with developers by committing to take equity stakes in the developer’s project. This is done to secure orders and for mutual interests in the project. Further down the supply chain hierarchy, product suppliers often find themselves being forced to enter into strategic partnerships to bridge requirements for a wider scope of supplies. Technology suppliers often need stronger partners in order to finance de-risking programs and withstand contractual liabilities and/or delivery schedules. Some companies have partnerships embedded in their DNA, while others take an arms-length approach.

#17 FINANCIAL EXPOSURE

Financial Exposure is a measure for a company’s ability to withstand the required contractual liabilities. Due to the ever increasing size of wind farms, contract values are often high. And to mitigate the risk of serial defects and delayed revenue streams, it is not unusual with 50% or 100% contract value caps to LD’s and liabilities. Liabilities are considered higher when introducing new technologies or new markets. Defect Notification Periods often run for several years, and 10-30% of performance guarantees need to run through this period. This means that the financial exposure of a company rapidly increases to levels that were not foreseen when the business plan was made. Special insurances can be used to leverage the exposure and improve the value proposition to the clients and their financiers.

#18 EXPANDED OFFERING

Expanded Offering is a measure for the ability to use an established position in the offshore wind market for an expanded offering through organic or inorganic growth. This alternative to partnerships can be used as means for differentiation, or it can be used to climb up the supply chain hierarchy. In addition to increased business, contractual exposure and new risk elements are introduced when expanding the offering to the market. Careful evaluation is needed when choosing between partnerships and expanding the in-house offering.

CHRISTMAS REFLECTIONS FROM THE MARKET

A bidding round for bottom-fixed offshore wind farms is currently ongoing in Japan after almost a decade of preparations and considerations. More bottom-fixed and floating wind farm bidding rounds are expected to follow soon. Meanwhile, the Japanese government just decided on an ambitious target of 45GW of offshore wind capacity by 2040! In such an ambitious market with very little established offshore wind supply chain, there are great opportunities for the local Japanese industry if teamed up with experienced offshore wind suppliers. Also, for non-Japanese companies with experience ín offshore wind, business can be obtained through local agents that know the Japanese culture, stakeholders and companies.